The Federal Reserve goes big and left a mark on the world on Wednesday, supporting a third sequential 75-premise guide climb in a forceful push toward tackle the white-hot expansion that has been tormenting the US economy.

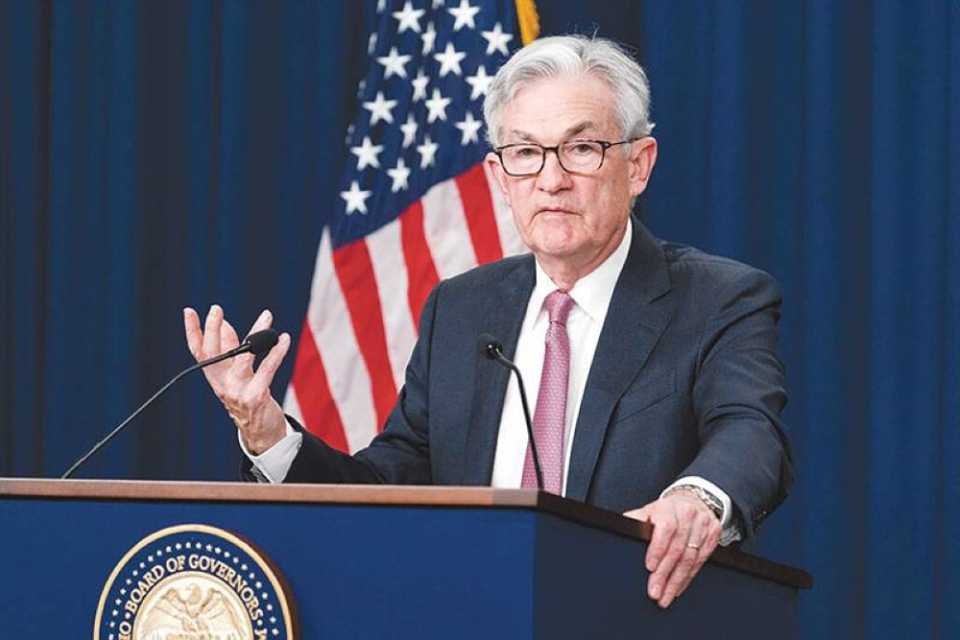

Taken care of Seat Jerome Powell talks at 2:30 p.m. ET, and he is supposed to underscore the national bank will take the necessary steps to battle expansion and it is probably not going to turn around its rate climbs at any point in the near future.

Key Highlights:

l The Central bank started its two-day meeting Tuesday, and financial specialists anticipate that the national bank should declare a third successive three-quarter point rate climb.

l “This is truly moving into prohibitive financial arrangement region. We will be moving into a dead zone,” said one financial specialist. “We really haven’t fixed arrangement to battle expansion since the mid 1980s.”

l Any amazement’s might come in the Federal Reserve’s quarterly projections on expansion, the economy and loan costs.

The supersized climb, which was incredible by business sectors only months prior, takes the national bank’s benchmark loaning rate to another objective scope of 3%-3.25%. That is the most elevated the fed supports rate has been since the worldwide monetary emergency in 2008.

Wednesday’s choice denotes the Federal Reserve’s hardest arrangement move since the 1980s to battle expansion. It will likewise logical reason monetary torment for a huge number of American organizations and families by pushing up the expense of getting for things like homes, vehicles, and Visas.

Federal Reserve Director Jerome Powell has recognized the financial torment this fast fixing system might cause.

“We should keep at it until the task is finished,” he said at an August national brokers’ gathering in Jackson Opening, Wyoming. “While higher loan fees, more slow development, and gentler work economic situations will cut down expansion, they will likewise carry an aggravation to families and organizations. These are the sad expenses of diminishing expansion. Yet, an inability to reestablish value soundness would mean far more noteworthy torment,” he cautioned.

The Federal Reserve’s refreshed Outline of Financial Projections, delivered Wednesday, mirrors that aggravation: The quarterly report showed a less hopeful viewpoint for monetary development and the work market, with the middle joblessness rate crawling up to 4.4% in 2023, higher than the 3.9% Took care of authorities projected in June and considerably higher than the ongoing pace of 3.7%.

US GDP, the primary proportion of monetary result, was modified down to 0.2% from 1.7% in June. That is well underneath experts’ assessments: Bank of America financial specialists had assessed that Gross domestic product would be reexamined to 0.7%.

Expansion projections additionally developed. Center Individual Utilization Consumption’s, the Federal Reserve’s leaned toward proportion of rising costs, is projected to hit 4.5% this year and 3.1% in 2023, the Federal Reserve’s SEP showed. That is up from June projections of 4.3% and 2.7%, separately.

Maybe generally critical to financial backers looking for forward direction from the Federal Reserve is the projection of the government subsidizes rate, which frames authorities’ thought process is the proper approach way for rate climbs proceeding. The numbers delivered on Wednesday showed that the Federal Reserve expects financing costs to stay raised long into the future.

The middle government subsidizes rate projection was modified upwards for 2022 to 4.4% from 3.4% in June. That number ascents to 4.6% from 3.8% for 2023. The rate was likewise updated higher for 2024 to 3.9% from 3.4% in June and is supposed to stay raised at 2.9% in 2025.

In general, the new projections show the developing gamble of a hard landing, where financial strategy fixes with the end result of setting off a downturn. They additionally give a proof that the Federal Reserve will acknowledge “torment” in monetary circumstances to cut down persevering expansion.

The greater costs imply that customers are spending around $460 more each month on food than they were this time last year, as indicated by Moody’s Investigation. In any case, the work market serious areas of strength for stays, does purchaser spending. Lodging costs stay high in numerous areas, despite the fact that there has been a significant spike in contract rates. That implies the Fed might feel that the economy can swallow more forceful rate climbs.

Taken care of Seat Powell is set to talk at a public interview at 2:30 p.m. ET to talk about the national bank’s approach declaration.

The Fed has been lifting rates for a very long time at this point, and will currently be moving its objective rate above what had been viewed as the impartial zone when expansion was low. Unbiased is viewed as the loan fee level where Taken care of strategy is at this point not simple yet not yet prohibitive. The Fed has considered 2.5% to be impartial, and in the event that it raises by 3/4 of a point, the fed finances rate will be in a scope of 3% to 3.25%.

“This is truly moving into prohibitive money related approach an area. We will be moving into a dead zone,” Swonk said. “We really haven’t fixed approach to battle expansion since the mid 1980s. Their objective is for a delayed stoppage that grinds expansion gradually down and just step by step builds the joblessness rate. Whether they arrive is another issue.”

Rate expectations jumped:

Financial analysts have been tightening up their estimates for how high they anticipate that the Fed should accept the fed supports focus prior to halting the climbs. That level is known as the terminal rate.

Assumptions for Took care of fixing expanded decisively in the previous week, after a shockingly hot August purchaser cost file report. Taken care of assets fates on Monday were valuing in a terminal pace of 4.5% by April, up from just around 4% before the expansion report was delivered last Tuesday.

The CPI rose 0.1% in August, while financial experts had anticipated a downfall.

“The CPI number last week caused a ton as far as market repricing,” said Peter Boockvar, boss speculation official at Bleakley Warning Gathering. Stocks have been auctioning off, and security yields shot higher after that report, with some transient Depository yields transcending 4%. The 10-year Depository yield rose to 3.59% Tuesday, the most noteworthy since April, 2011.

The Federal Reserve’s last conjecture, in June, assessed the terminal rate for took care of assets to be at 3.8% in 2023.

Financial experts currently anticipate that the Fed should raise the terminal rate estimate above 4%. Citigroup financial experts said they might really see a situation where it could go above 5% if the Fed needs to get more forceful in its expansion battle.

Goldman Sachs financial experts, in a report, said they expect the middle gauge of Taken care of authorities to show the assets rate at 4% to 4.25% at year-end, with one more climb to a pinnacle of 4.25% to 4.5% in 2023. They then expect a cut in 2024 and two more in 2025.

Labor market pain:

Swonk anticipates that a portion of that aggravation should appear a leap in the joblessness rate to above 5% toward the following year’s end.

In June, the Fed conjecture the joblessness rate would be 3.7% this year, a similar level as August. Taken care of authorities likewise anticipated that joblessness should ascend to 3.9% in 2023 and 4.1% by 2024.

“I believe they will be a little light on the joblessness rate. I’m in the camp that they need to truly expand the joblessness rate to truly gain ground with expansion,” said Jim Caron, Morgan Stanley Speculation The board’s head of full scale techniques for worldwide fixed pay. “They’re in the camp of ‘We don’t need to do that.”

Caron said the Federal Reserve’s rate climbing is a cycle that will expand the gamble of downturn.

“By expanding downturn chances, you lower expansion gambles since everything no doubt revolves around lessening interest in the economy,” he said. “The penance is more slow development later on.”

There are a few financial backers risking everything and the kitchen sink will raise rates by a full rate point, yet most financial analysts imagine a 75 premise point increment. A premise point rises to 0.01 of a rate point.

“I think 75 premise focuses is essentially prepared into the cake,” said Caron. “Presently, it will be about everything they really say to us … . They would rather not do advance direction, however actually individuals are as yet going to check out at them for forward direction.”

‘Out-hawk’ the market:

Powell has taken on a more hawkish tone. He gave a short and direct discourse at the Federal Reserve’s yearly Jackson Opening conference in late August, where he cautioned the economy could be in for torment from Took care of fixing. The seat focused on that the Fed will utilize monetary information to direct approach, and he has additionally accentuated that policymakers will hold rates at significant levels until expansion facilitates.

“I figure the message will be to a great extent equivalent to Jackson Opening,” said Michael Gapen, boss U.S. business analyst at Bank of America. “It will be tied in with getting strategy prohibitive, getting it there for a while with the general objective being cost strength.”

Caron said it’s conceivable Powell could sound coincidentally timid on the grounds that the Fed has shifted exceptionally hawkish.

“I think a 75 premise point move is darn hawkish, the third one straight,” said Caron. “I don’t think they need to strive to ‘out-sell’ the market.”